The Vanguard Research Initiative

Thank you once again for your interest and participation in the Vanguard Research Initiative. This very brief summary of key findings is intended to give you a high level sample of some of the work we have completed using the data provided by Vanguard Research Initiative (VRI) participants.

The VRI has resulted in presentations of our analyses and results at academic seminars across the country and in forums in Washington DC, three completed full-length research papers submitted for publication in refereed academic journals, a number of press articles, and better understanding of several aspects of Vanguard client circumstances and motivations. While we have completed a large amount of research already, we believe there is much more to come, and we hope for your continued participation.

Overview

The VRI is a collaboration of the University of Michigan, New York University, and Vanguard.

The VRI examines decision making of older Americans with sufficient financial resources to face meaningful tradeoffs between consumption across time, between spending when well and when in need of assistance, between retiring and working longer, between long-term care in private or publically-funded facilities, and between leaving bequests versus spending in various health states.

The project employs data on a panel of savers that includes detailed wealth, health, and demographic information. This panel data set comprises over 9,000 Vanguard clients who consented to participate in the study. By the joint use of administrative account data and surveys, the project employs an innovative infrastructure for understanding the decision making and well-being of older Americans. The project also innovates by combining this distinctive measurement infrastructure with survey questions, modeling, and estimation that can yield precise quantification of the considerations that affect decision making and well-being leading up to retirement and during retirement. A key innovation is to pose strategic survey questions (SSQs), a form of contingent stated preference question.

Why study Vanguard respondents?

Our effort intends to study the decisions of Americans who have meaningful financial resources. Currently available datasets have far fewer observations of households with significant levels of financial wealth. The VRI fills that gap.

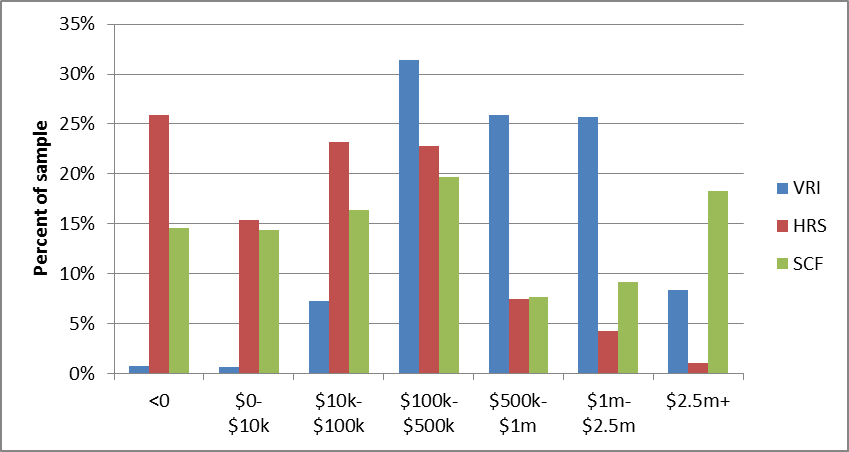

The figure below shows the distribution of VRI respondents, by wealth level, for age-eligible survey respondents from the VRI (Vanguard Research Initiative), the HRS (Health and Retirement Study), and SCF (Survey of Consumer Finances). The HRS and SCF are commonly used sources of wealth data for the study of retirement. The chart shows the uniqueness of the VRI: Fully 83% (the sum of the three tallest blue bars) of the VRI sample has between $100k-$2.5m in financial assets. The other two surveys are dominated by respondents with less than $500k in assets.

Comparison of Distribution of Total Financial Wealth

Of course, the other two surveys are more representative of the broader US population. There are a large number of American households with low levels of financial wealth. Studying their behavior is a research priority, but not one that we attempt to focus on in the VRI. Our work focuses on the issues and decisions faced by those who have achieved the goal of accumulating significant financial wealth. The importance of our findings is likely to grow as more and more Americans fall into that category.

Studying important decisions in retirement

Using the VRI data, in conjunction with well-specified theoretical models and advanced statistical methods, we can better measure potential drivers of demand (or lack of demand) for various forms of insurance. For example, VRI respondents spent a great deal of time answering unique and nuanced questions regarding annuities and long-term care.

In general, our analysis of this data has led us to believe that current methods for studying financial decisions (including both the stripped down versions of the economists’ well-known life-cycle model as well as some more sophisticated augmentations) do not accurately capture patterns we see in the data. We have found a persistent disconnect between the predictions of typical models and the data provided and behaviors observed.

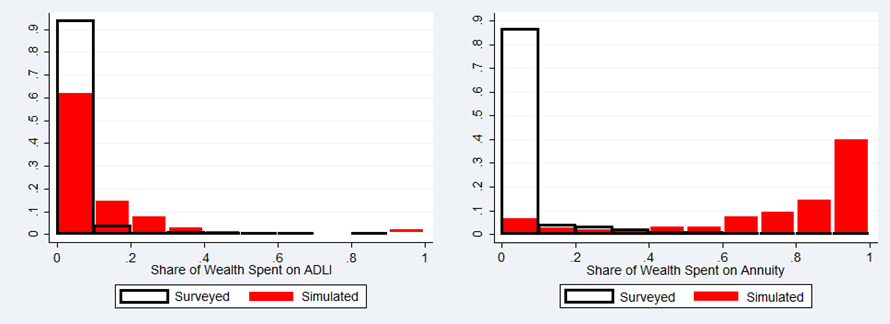

For example, the figure below illustrates our bottom line result for immediate annuities and long term care insurance (specifically, Activities of Daily Living Insurance, or “ADLI”): Even in a highly sophisticated, rich modeling framework, we observe that the demand predicted by current models remains far in excess of stated/observed demand. In both cases more than 85% of the sample of VRI respondents (.85 on the Y-axis in the histograms) reported negligible demand for these forms of insurance. The red bars show what current, state of the art theories would have implied.

Survey Demand versus Modeled Demand for Insurance

Further improvement of our understanding of investor motivations in retirement is desperately needed. We believe that an underexplored, critical aspect of household insurance decisions involves the family and the motives that underlie wealth transfers to loved ones. Concern for family, gifts, transfers, and estates were the subject of an entire submodule in the 2014 VRI. Using this data to better understand motivations and to explain decisions—and to create better financial solutions—is a key objective in our ongoing work.

VRI data enables better estimation of key relationships

Having large amounts of good data in the VRI also enables us to better estimate important economic relationships. For example, we can use the VRI data to refine estimates of the potentially nonlinear relationship between retirement horizon (number of years to/from retirement) and wealth (as measured by replacement rate, or the ability of wealth to be converted to replacement income). In other words, we can study how strongly changes in wealth are related to retirement expectations. The richness of the data, along with the application of sophisticated techniques, enables significant confidence in our results.

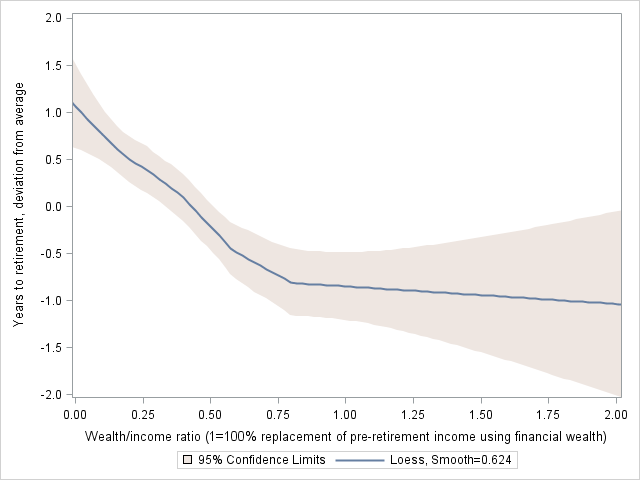

The chart below summarizes overall patterns we have gleaned from the VRI data. The analysis here confirms a quite surprising result seen in other datasets: retirement horizons and wealth levels are only weakly linked. Based on the overall pattern (implied by the blue line) moving from zero wealth to an amount that could replace current income (normalized wealth = 1) corresponds to a reduction in expected years of work of only about 1.7 years, holding other income, age, marital status, education and health constant.

Retirement Horizon and Normalized Replacement Rate from Wealth

Given this surprising and very important result, we hope to augment the information and analysis we have produced with additional data on attitudes about work and retirement transitions to better understand and model these critically important behaviors. This is an area of research and a finding that has important connections to very practical issues, including the design of investment products and services such as target date funds.

Thank you

There is a great deal more work in progress using the VRI data on these important topics and others, and we look forward to continuing this groundbreaking project with you. We thank you very much for your continued participation.